The development of a comprehensive Key Performance Indicator (KPI) dashboard for Quantum Pulse Consulting’s Project Amin presents a significant opportunity to transform the evaluation process for potential investment companies. By integrating principles from venture capital, artificial intelligence, and cybersecurity, this research provides a foundation for creating a sophisticated assessment tool that measures operational maturity, investment readiness, and long-term impact potential. The dashboard will leverage data-driven methodologies, incorporate cybersecurity posture evaluations, and implement robust quality assurance practices to deliver an innovative solution that aligns with QPC’s core values of integrity, innovation, and user-first design.

Dashboard Design Best Practices for Startup Evaluation

The effectiveness of any KPI dashboard begins with intentional design principles that consider both function and audience. In the context of evaluating startups for investment potential, several critical design principles emerge as particularly important.

Establishing Clear Dashboard Objectives

Before implementing any visualizations or metrics, it’s essential to determine the specific goals of your dashboard based on stakeholder needs. For Project Amin, this means understanding what investment decision-makers need to evaluate when considering AI and cybersecurity startups. The dashboard should consolidate reporting requirements from different stakeholders through direct interviews and requirement-gathering sessions. This approach ensures that the dashboard serves a clear purpose and answers key questions through appropriate data visualization.

Not all available data will be equally valuable for investment analysis. By carefully considering which metrics will bring value to your investment evaluation goals, you can avoid creating a cluttered, ineffective dashboard. When designing the dashboard, ask: What precisely needs to be measured? Who will measure it? What time intervals are most meaningful for this evaluation process?

Selecting Relevant KPIs for Startup Assessment

After establishing your dashboard objectives, selecting appropriate KPIs becomes critical. For venture capital applications, these KPIs must reflect the unique characteristics of startup evaluation rather than traditional business metrics. Effective KPIs for startup assessment should align with both the dashboard goals and the target audience’s analytical needs[1].

KPIs in this context serve as narrative elements that tell a compelling story about each potential investment. Interactive KPIs can capture your investment team’s attention and break down complex findings into digestible insights. This storytelling approach creates a more engaging assessment experience that leads to better investment decisions[1].

Implementing Data Storytelling Techniques

Data storytelling represents a fundamental component of effective dashboard design for investment evaluation. This approach involves presenting data visually to convey the entire analytical narrative, helping stakeholders understand business strategies and goals. Effective storytelling bridges the gap between technical users and those less familiar with data analysis[1].

A recommended practice for startup evaluation dashboards is designing the visualization approach before implementation. Planning your charts and visualizations based on your audience and goals allows for more focused dashboard development. Rather than combining visualizations randomly, this strategic planning approach generates reports that consider the technical understanding of users and aligns with evaluation objectives[1].

Data-Driven Assessment Models in Venture Capital

The venture capital industry is experiencing a transformation driven by data analytics and AI technologies. Understanding the spectrum of data maturity in VC firms provides valuable context for Project Amin’s development.

The VC Data Maturity Spectrum

Modern venture capital firms can be categorized along a data maturity spectrum that reflects how they incorporate technology and data into their decision-making processes:

Traditional VCs (low data maturity) rely predominantly on personal networks, relationships, and referrals for deal sourcing. Their investment decisions are based largely on intuition and qualitative information, with minimal use of technology. Portfolio management typically involves manual processes using basic spreadsheets and CRM systems[2].

Productivity-Focused VCs (medium data maturity) utilize off-the-shelf tools, websites, and basic AI agents to assist with deal flow. Their decision-making process combines human judgment with data-backed insights, though AI tools serve primarily as secondary support. These firms implement integrated tools for portfolio management but still require significant manual oversight[2].

Data-Driven VCs (high data maturity) employ sophisticated machine learning and predictive analytics to automate deal sourcing and evaluation. Their decision-making is led by comprehensive data analysis that provides deep insights on market trends, competitors, and forecasts. Portfolio management is fully automated with AI-driven prediction capabilities and advanced platforms that centralize data across geographies and sectors[2].

Key Assessment Pillars for VC Evaluation Frameworks

Effective VC evaluation frameworks typically incorporate several key pillars for comprehensive assessment:

- Deal Sourcing and Efficiency: This evaluates how effectively the firm identifies and processes potential investments. Data-driven firms use AI to automate sourcing and evaluation based on market fit, team strength, and financial potential[2].

- Decision-Making Process and Insights: This examines how investment decisions are made, ranging from intuition-based approaches to data-led analytics that eliminate biases and provide real-time insights[2].

- Portfolio Management and Scaling: This assesses the firm’s ability to track performance and optimize operations across its investment portfolio. Advanced firms implement fully automated systems with predictive capabilities[2].

By understanding these assessment pillars, Project Amin can develop a dashboard that not only evaluates startups but also positions QPC as a data-driven evaluator with sophisticated assessment capabilities.

Key Metrics for Evaluating AI and Cybersecurity Startups

The intersection of AI and cybersecurity creates unique evaluation challenges and opportunities. Project Amin’s dashboard should incorporate industry-specific metrics that accurately reflect startup maturity in these technical domains.

AI-Driven Threat Detection Metrics

For cybersecurity startups, particularly those leveraging AI technologies, several critical performance indicators can reveal operational effectiveness:

Detection Rate measures the percentage of actual threats identified by the system. A high detection rate indicates effective threat recognition capabilities. For example, if a startup’s AI system detects 90 out of 100 actual threats, the detection rate is 90%[3].

False Positive Rate assesses the frequency of benign activities incorrectly flagged as threats. Lower false positive rates indicate better system accuracy and allow security teams to focus on genuine threats. For instance, a 10% false positive rate means 10 false alerts generated out of 100 total alerts[3].

Time to Detection (TTD) represents the average time required to identify a threat after occurrence. Startups with lower TTD values demonstrate superior threat detection capabilities, with industry leaders measuring TTD in minutes rather than hours or days[3].

Response Time evaluates how quickly the system reacts once a threat is detected, including both automated responses and alerts to security personnel. Faster response times indicate more effective threat mitigation capabilities[3].

Financial and Operational Readiness Metrics

Beyond cybersecurity performance, investment-ready startups should demonstrate financial viability and operational efficiency:

AI-Powered Financial Modeling capabilities allow startups to generate dynamic financial projections based on historical data, market trends, and real-time insights. These models provide predictive cash flow forecasts and break-even analyses that showcase financial sustainability to potential investors[4].

The quality of a startup’s Investor Pitch Deck can be objectively assessed using AI tools that analyze presentation flow, financial metric inclusion, and market positioning. Advanced startups leverage these tools to optimize investor engagement rates through data-driven improvements to their presentations[4].

Risk Assessment Processes evaluate a startup’s comprehensive risk profile by examining financial history, market conditions, and industry benchmarks. Mature startups proactively identify and address potential risks before investor discussions, demonstrating advanced due diligence capabilities[4].

Integrated Performance Dashboards

For the most sophisticated evaluation, these metrics should be integrated into comprehensive dashboards that visualize key performance trends:

This structured approach to metric visualization enables quick comparison between different startups and against industry benchmarks, facilitating more informed investment decisions[3].

Integrating Cybersecurity Posture Assessments into Investment Scoring

For Project Amin to deliver maximum value, cybersecurity evaluation must be integrated directly into the investment scoring methodology, creating a comprehensive risk assessment framework.

NIST Cybersecurity Framework Integration

The National Institute of Standards and Technology (NIST) cyber risk score methodology provides a structured approach to evaluating security posture. This methodology is not a single metric but rather a comprehensive evaluation system based on the NIST Cybersecurity Framework’s principles[5].

Implementation involves identifying relevant security controls, assigning weights to each control (on a scale of 1-10) based on its significance to overall security, and evaluating the effectiveness of these controls within the startup being assessed. The resulting score provides a snapshot of the organization’s risk posture, highlighting both strengths and areas requiring attention[5].

The NIST Cybersecurity Framework employs a five-level scale encompassing “Identify,” “Protect,” “Detect,” “Respond,” and “Recover” phases. This provides a comprehensive roadmap for evaluating a startup’s security maturity across the entire security lifecycle[5].

User Behavior Analytics as a Security KPI

Beyond technical security measures, User Behavior Analytics (UBA) represents an advanced approach to cybersecurity assessment. This KPI evaluates how well a startup monitors and analyzes user activities to detect insider threats and anomalous behaviors[3].

Implementing UBA demonstrates a sophisticated security posture that looks beyond perimeter defenses to identify threats that may originate from within the organization. Startups with strong UBA capabilities typically show enhanced overall security resilience and proactive risk management approaches[3].

AI-Enhanced Security Response Metrics

The integration of AI into security operations provides additional metrics for evaluation:

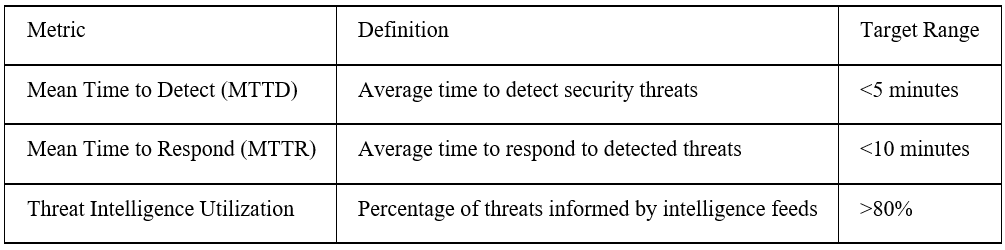

Mean Time to Detect (MTTD) measures how quickly security incidents are identified. AI-powered security systems typically demonstrate significantly reduced MTTD by continuously monitoring systems and analyzing data in real-time[3].

Mean Time to Respond (MTTR) evaluates the average time required to address detected incidents. AI-driven automation can streamline response actions, lowering MTTR and minimizing potential damage from security incidents[3].

Advanced startups implement comprehensive AI-driven security operations that provide faster detection and response capabilities, enhanced decision-making through actionable insights, and optimized resource allocation by automating routine security tasks[3].

Project Management Frameworks for Dashboard Implementation

Successful implementation of Project Amin requires a robust project management approach that balances budget constraints, timeline requirements, and quality expectations while addressing compliance requirements.

Compliance-Focused Project Management

Implementing a KPI dashboard that evaluates investment targets requires careful compliance management. This begins with confirming project compliance requirements across domains including security, health and safety, and regulatory standards[6].

Most organizations have non-negotiable compliance aspects that must be addressed in any project. For Project Amin, these would include data privacy regulations, financial reporting requirements, and industry-specific compliance standards. Failure to meet these standards would compromise the project’s viability regardless of other successes[6].

Quality Management Plan Execution

Quality assurance for Project Amin should focus on executing a comprehensive quality management plan. This involves employing tolerances, specialized QA tools, and regular audits to verify compliance with quality standards[6].

When compliance issues arise, the project management framework should include established processes for remediation. This creates a continuous improvement cycle that maintains quality standards throughout the project lifecycle and ensures the final dashboard delivers accurate, reliable investment insights.

Dependency Management and System Integration

The complex nature of a KPI dashboard that spans venture capital, AI, and cybersecurity domains necessitates careful dependency management. The project management approach should identify system dependencies early in the development process and establish integration points between different components.

A phased implementation approach allows for validation of individual components before full system integration. This reduces risk and enables earlier identification of potential issues, especially around data interoperability and security integration.

Examples and Case Studies of Data-Driven VC Approaches

While comprehensive case studies were limited in the available search results, several examples illustrate the principles that should guide Project Amin’s development.

Financial Modeling Automation

Advanced venture capital firms leverage AI tools like Jirav and QuickBooks to predict funding requirements through automated analysis of revenue projections and expense forecasts. This approach enables real-time financial modeling that adapts to changing market conditions and provides more accurate investment forecasting[4].

The key lesson from these implementations is the importance of maintaining current data inputs. Successful systems automatically update financial models with real-time performance data, ensuring that investment decisions are based on the most current information available[4].

Presentation Optimization Tools

Investment pitch optimization represents another area where data-driven approaches demonstrate measurable impact. Tools like Beautiful.ai analyze successful pitch decks to suggest design enhancements and key metrics that maximize investor engagement[4].

Startups using these tools show measurably improved investor engagement rates through optimized content and delivery. This data-driven approach to presentation design reflects a sophisticated understanding of investor psychology and decision-making processes[4].

VC Maturity Evolution

The transition from Traditional to Data-Driven VC operations illustrates how investment firms can evolve their assessment capabilities. This progression typically involves:

- Initial adoption of basic tools to organize deal flow and portfolio information

- Implementation of integrated platforms that connect different operational areas

- Development of predictive capabilities that leverage historical data for forward-looking insights

- Full automation of routine assessment processes with AI-driven decision support

This evolutionary path provides a potential roadmap for Project Amin’s development, allowing for staged implementation of increasingly sophisticated capabilities[2].

Conclusion: Strategic Framework for Project Amin Implementation

The development of a KPI dashboard for startup evaluation represents a significant opportunity for Quantum Pulse Consulting to transform its investment assessment process. By integrating best practices in dashboard design, data-driven VC methodologies, specialized metrics for AI and cybersecurity startups, and robust project management frameworks, Project Amin can deliver a solution that embodies QPC’s values of integrity, innovation, and user-first design.

Successful implementation will require balancing technical sophistication with usability, ensuring that the dashboard provides meaningful insights without overwhelming users with excessive complexity. By focusing on the storytelling aspects of data visualization and implementing a phased approach to development, Project Amin can deliver immediate value while establishing a foundation for future enhancements.

The resulting dashboard will not only improve investment decision-making but also position QPC as a leader in data-driven venture assessment, particularly in the high-growth sectors of AI and cybersecurity. This strategic positioning aligns with broader industry trends toward greater quantification of investment readiness and provides a competitive advantage in identifying promising investment opportunities.

⁂

1. https://www.rib-software.com/en/blogs/bi-dashboard-design-principles-best-practices

2. https://www.linkedin.com/pulse/vc-data-maturity-framework-scorecard-abcxchange-vspef

3. https://www.restack.io/p/ai-powered-cybersecurity-answer-kpi-examples-cat-ai

4. https://composabilityscores.com/2025/02/05/how-ai-is-revolutionizing-startup-investment-readiness/

5. https://fortifydata.com/blog/what-is-the-nist-cyber-risk-score/